The NPDB: Facts, Context, and Common Misconceptions

The National Practitioner Data Bank (NPDB) was established by Congress under the Healthcare Quality Improvement Act of 1986. Its purpose is to improve patient care by encouraging healthcare organizations to identify practitioners who engage in unprofessional conduct.

The NPDB collects and maintains reports on a wide range of actions, including medical malpractice payments, state and federal licensure or certification actions, adverse clinical privileges actions, professional society membership actions, peer review findings, healthcare-related criminal convictions, civil judgments, and exclusions from participation in federal or state healthcare programs such as Medicare and Medicaid. These reporting requirements apply to all licensed healthcare providers, including CRNAs.

Medical Malpractice Payments and NPDB Reporting

Medical malpractice settlement reports capture instances in which a settlement or judgement is paid on behalf of a clinician, triggering mandatory reporting to the NPDB regardless of whether fault is admitted (resource). These reports are typically submitted by malpractice insurers, self-insured hospitals, or other healthcare entities. By law, any malpractice payment made on behalf of a practitioner must be reported, regardless of the amount.

Reports must be submitted to the NPDB and the appropriate state licensing board within 30 calendar days of payment. Failure to report a required payment can result in fines of up to $27,894 for the payer as of August 2024

What Is Not Reportable

Payments made directly by a healthcare provider from personal funds are not reportable to the NPDB. Additionally, debt forgiveness or write-offs—such as waiving a medical bill following a patient complaint—are not reportable events.

Who Can Access NPDB Information

NPDB information is available only to eligible entities, including hospitals, state licensing boards, and state or federal law enforcement agencies. The NPDB is not accessible to the general public.

Why Consent to Settle Matters

If you purchase your own malpractice insurance, it is important to ensure your policy includes a consent-to-settle provision. This provision prevents an insurer from settling a claim without your approval, helping protect your professional record.

Employer-Provided Coverage Considerations

When malpractice coverage is provided by an employer or facility, defense counsel is typically appointed by the employer’s insurer. In some cases, claims may be settled to limit expenses, even when no breach of the standard of care occurred. Such settlements can still result in NPDB reports.

For this reason, some CRNAs choose to carry individual malpractice insurance in addition to employer-provided coverage. AANA Insurance Services offers a low-cost, occurrence-based policy that provides independent legal representation focused on protecting your interests and professional reputation.

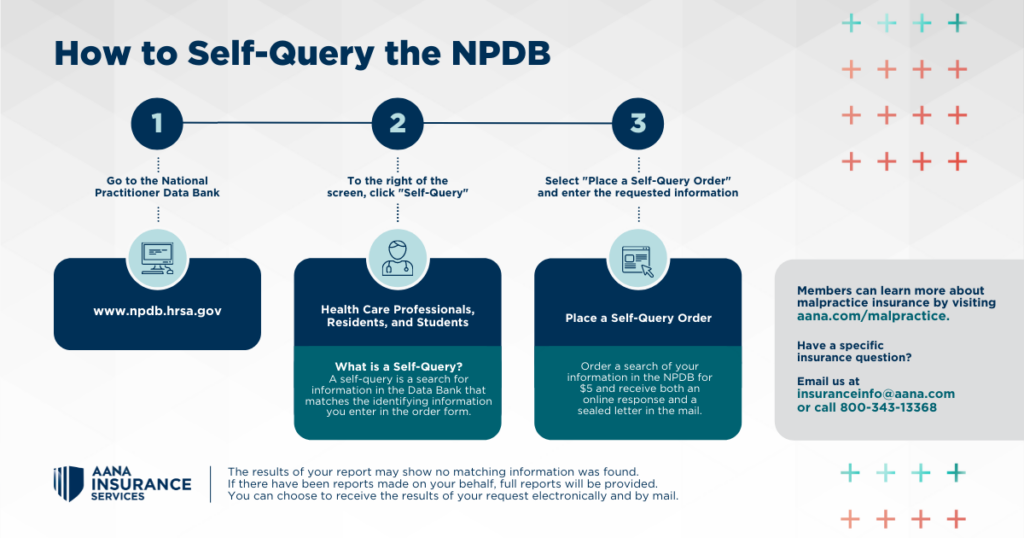

Self-Querying the NPDB

If you have not always carried your own malpractice insurance, it is advisable to self-query the NPDB every three to five years. This allows you to confirm whether any reports exist and address potential issues proactively—before applying for future employment.

Additional Resources

- National Practitioner Data Bank (NPDB). NPDB. Accessed January 8, 2026. https://www.npdb.hrsa.gov/

- U.S. Department of Health and Human Services; Health Resources and Services Administration; Bureau of Health Workforce. NPDB Guidebook. October 2018. Accessed January 8, 2026. https://www.npdb.hrsa.gov/resources/NPDBGuidebook.pdf

- American Association of Nurse Anesthesiology (AANA). How to Self-Query the National Practitioner Data Bank. AANA NewsBulletin. January 2019. Accessed January 8, 2026. https://www.aana.com/file-download/how-to-self-query-the-national-practitioner-data-bank/

- Jordan LM, Ouraishi JA, Liao J. The National Practitioner Data Bank and CRNA anesthesia related-malpractice payments. AANA J. 2013;81(3):178-182. https://www.aana.com/wp-content/uploads/2023/01/the-national-practitioner-data-bank-and-crna-anesthesia-related-malpractice-payments.pdf

- Jordan LM, Quraishi JA, Liao J. The National Practitioner Data Bank: What CRNAs need to know. AANA J. 2013;81(2):97-102. https://www.aana.com/wp-content/uploads/2023/01/the-national-practitioner-data-bank-what-crnas-need-to-know.pdf

Learn About Your Policy Options

Contact Us

Phone: 800-343-1368

Email: insuranceinfo@aana.com